Do you need to hire a pitch deck designer? Click here to post up a job and top quality designers will contact you with their rates.

Seeking startup investment for the first time? You might be wondering how long the whole funding process will take. There are so many anecdotes about how such-and-such raised their first seed round in 2 weeks, or how it took this one startup 2 years to raise. Where do you fit into those timescales?

When you come to fundraise yourself, you need a ballpark figure of how long it’ll take your startup to close a seed round. We’ll investigate the reality of the funding process to help you better understand how long it will take. If you’re prepared, you can achieve results faster.

Just tell me how long it’ll take!

Ok, here’s the deal. Although there are stories of startups closing a round of funding in a few weeks, these are rarities and that’s why they catch the headlines.

This is not the reality for most startups. In fact, it’s best not to compare yourself to other startups because everyone is different. True, some startups can close funding in a week. Others will take a year.

It’s impossible to say exactly how long fundraising will take for your startup. In general, you should prepare yourself for at least a few months before receiving a startup investment.

Sorry, we know that’s a vaguer answer than you were hoping for. As you’ll find out, there are so many depending factors. We’ll talk you through them in this article.

It also depends on what kind of fundraising you’re doing. In this article, we’re talking specifically about seed funding. If you’re a series A, B, or C or raising through VCs, your process and timescale will be different. Work on this pitch deck template while you wait and study these examples that got funded.

When to raise startup investment

How do you know the time is right to start the fundraising process? All the pros will tell you to only raise “when you’re ready“.

But, you’re a startup, when will you ever be ready? Your product is always a work in progress, you’re always close to achieving another milestone… in the end, you just have to take the leap and begin the fundraising process.

Even so, here are some tips to help you know when it’s the right time for your startup to raise:

- You’ve got your pitch nailed.

- You have sufficient cash runway to give a bit of leeway. The more runway you have, the better position you’ll be in for negotiating with investors. Runway = leverage.

- Due diligence questions can be answered effortlessly.

- Your startup has achieved key milestones which can be used to get you the valuation you want.

You suck at first

Hate to break it to you, but the first few times you pitch, it will suck. Getting great at pitching takes practice. So what are you waiting for? Practice, practice, practice! Most startups only realize this when they begin pitching to investors.

Instead of using up your first few investor meetings as pitching practice, try out your pitch on anyone who’ll listen. Colleagues, peers, friends, relatives, your dog…

Then, when you do go into your first proper startup investment meeting, you’ll be a finely tuned machine and this will help speed up the fundraising process.

Nothing happens instantly

Be prepared for it to take time for meetings to be arranged. You’re keen to get off the starting block, but angel investors are busy people. It can take a couple of weeks to go from intro to meet. Be patient, but also remember to follow up.

As you’re going through the fundraising process, you’ll find yourself getting more intros. Angels will refer you to other angels in their network. All of these leads should be acted on. This adds additional time to the funding process.

Funding process follow ups

If the people you meet are interested, they might ask for further information. They’ll want stats, data, more info on the team, etc. You might not have all this to hand, so it could take you a few days to pull it together.

Pick your team

Once you’ve got investors interested, start putting together your investment lineup. There are a couple of things to consider at this stage:

Figure out how much people should invest:

Take some time to determine how much each investor will put in. Do you want one person to put in more, and therefore be able to control more of the voting rights?

Get them to commit:

Getting the first few investors committed is always the hardest part, and can drag the process out. Nobody wants to make that initial leap, but once they do, you’ll find others will quickly follow suit.

Your valuation:

Use startup valuation services to provide an assessment that will allow you to bring the best people on board

Late to the party

You might find you get a couple of late investors who want to jump in right at the very end. It can be wise to leave a little something available for these people. Remember, you’ll still be meeting new people up to the minute you close.

Where’s my money?

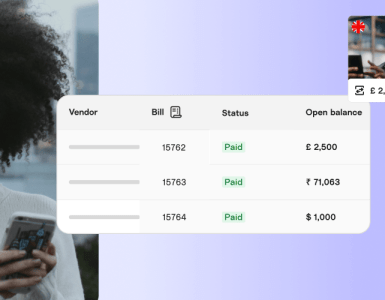

Never underestimate how long a wire transfer can take to process. These slippery things have been known to get lost, especially when transferring large amounts across continents. If you’re waiting on money it can add an extra couple of weeks to your startup investment.

Some investors, even once committed, can have a nasty habit of dragging their heels when it comes to signing on the dotted line. You might need to do some hand-holding in order to get their signature before the deadline elapses. Keep a keen eye on where each of your investors is up to in the process and don’t let anyone fall behind.

Keen to get Startup Investment now? Check out our investor megalist.

Want some advice from the front line? Find out how we raised over $1,200,000.