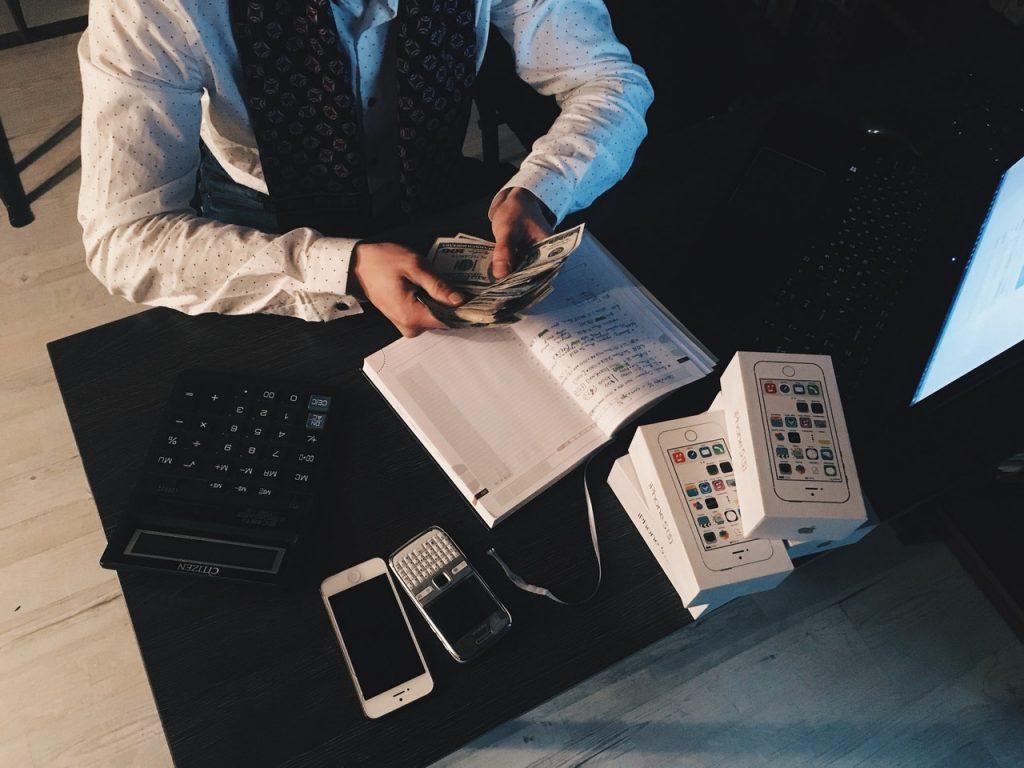

Is there anything more frustrating for freelancers than a client who doesn’t pay? A solid cash flow is key to keeping smaller enterprises afloat, and as most freelancers will tell you, a major obstacle to self-employed work is the lack of dependable income.

Currently, over £23.4 billion is owed in outstanding invoices to businesses across the UK, a figure that continues to grow as a result of Covid-19…

The problem is so widespread, that the government recently cut the current Prompt Payment Code deadline by 50%, giving customers 30 days to make payment in a bid to relieve pressure on smaller firms.

Whilst getting paid on time for freelance work is never a guarantee, putting in place good payment practices can help to avoid unnecessary stress and minimise the risk of delayed payments.

Know What Has Been Agreed: The Contract

When it comes to getting paid, it is important to be preemptive and draw up a contract for services that puts the details of your working relationship in writing. This keeps your finances secure, and your earnings safe.

This legal agreement ensures that both you and your client are happy with the terms of work, preventing any miscommunications ensuing along the way. It also puts you in better stead should the need to make a legal claim arise.

Clear Payment Terms

Your contract should include clear payment dates, automatic bill payment processes, and terms. Many self-employed workers choose to request an upfront payment of up to 50%. This deposit not only helps to ensure client motives, but it also keeps cash flowing through longer projects.

A down payment is considered standard practice, particularly when working with new clients, and therefore shouldn’t be too much of an issue. If you haven’t created a contract for your freelance services before, you can find a variety of templates online to help you get started.

Get Ahead: A Professional Invoice Practice

In order to get ahead, you shouldn’t allow too much time to pass between project completion and invoice request, as this will inevitably lead to delays in payment.

To avoid short term cash flow gaps and prevent a situation where a client doesn’t pay, you can issue your invoices at regular intervals, on a weekly or monthly basis. For larger projects, invoices can be sent at agreed roadmap milestones.

Alternatively, to avoid the potential headache of chasing payments, many freelancers choose to work with payment platform linking agencies. By selling your invoice in advance, you can receive your money faster, maintain consistent cash flow and completely eliminate the risk of late or non-payment.

‘Soft Touch‘ Invoice Chasing

There’s no doubt that chasing for payment when a client doesn’t pay is an irritating and time-consuming process you could do without.

Despite this, it’s important to consider your approach before making any rash decisions and burning bridges with said client. This is particularly true in the early stages when you don’t know the reason behind the late payment.

Rather than going in with all guns blazing, it is better to politely remind your client that payment is due. A gentle nudge is sometimes all it takes, and a friendly reminder is often far more persuasive than a rude or aggressive demand.

7 Day Payment Formal Request

If the softer approach is unsuccessful, you can move on to create and send off a Letter Before Action (LBA). This is a formal letter in which you request the payment of debt owed to your business, warning of a potential future court claim in the event of no payment.

In the demand letter, you should provide a set period of time in which the client has to pay (typically 7 days). Your tone here should be firm, showing clients that you are serious about pursuing the money you’re owed.

Whether you send your LBA by post or email, be sure to keep proof of postage or receipt in the event your client tries to deny having received it.

How To Collect Money From Clients Who Won’t Pay

These measures will hopefully be enough to ensure the outstanding balance gets paid in full. However, in the unfortunate event your client still refuses to pay, you should now consider taking legal action to ensure you aren’t left out of pocket. Whilst this might seem daunting, it may be the only way to recuperate your losses.

Small Claims Court

If the letter you have written is unsuccessful, your next step is to submit a Claim Form N1. If the defendant denies money owed or you are not satisfied with their response to your claim, you may need to go to court. However, in the event your claim is not responded to, the court will order payment.

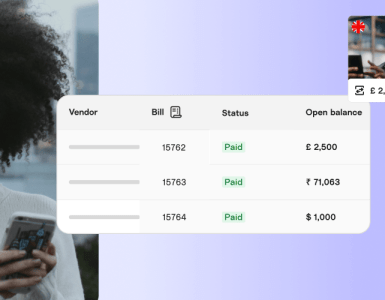

If the value of the claim you are making is less than £10,000, you can go through the small claims court. Be advised that a court fee is required to be paid when making a claim, and it is always cheaper to make the claim online.

Small claim amount | Form Fee (Paper) | Form Fee (Online) |

Up to £300 | £35 | £25 |

£300.01 – £500 | £50 | £35 |

£500.01 – £1,000 | £70 | £60 |

£1,000.01 – £1,500 | £80 | £70 |

£1,500.01 – £3,000 | £115 | £105 |

£3,000.01 – £5,000 | £205 | £185 |

£5,000.01 – £10,000 | £455 | £410 |

To avoid going to court, you also have the option to go through the small claims mediation service, a free service which helps you to reach a mutual agreement with the defendant for claims under £10,000.

Statutory Payment Demand

A statutory payment demand is an option if you are owed over £5,000 from an individual or £750 from a limited company. As long as you are able to prove that the debt is contractually due and you are certain your client has the money to pay you then you can issue a demand.

If the demand is undisputed and payment is not made within 21 days of its receipt, you are able to start insolvency proceedings and follow up with a bankruptcy or winding-up petition.

You don’t necessarily need a solicitor to serve a statutory payment demand, but you must give it to the individual who owes you money, or in the case of a limited company, send it recorded delivery to their registered office, or give it to a company director.

There are also certain records you should keep, including the time and date you served the demand and any proof the debtor has received it, eg. signed postage.

Recovery Specialists

If you feel you need assistance with getting late invoices paid, you can go through a collection agency that specialises in helping self-employed people and small businesses recover money owed from customers.

Recovery specialists have the knowledge and expertise required to provide professional negotiations – often offering a no collection, no fee service. Whilst they don’t hold any power in making companies pay up, they are able to conduct all communications for you.

If you choose this route, be sure to work with a credible company that you can trust to handle customer dealings on your behalf.

The Prompt Payment Code (PPC)

This code was created by the UK government in 2008 to set the ‘gold standard’ in payment terms, helping to bring about changes in poor payment practices. All signatories of the code promise to:

- Pay suppliers on time

- Give clear guidance on payment procedures

- Encourage good practice

As a further preemptive measure, before agreeing to work with a client you can check to see whether they have signed up to the PPC. Organisations that have become a signatory can use the PPC logo on their documentation or website to prove they are serious about making timely payments.

As we mentioned above, the government has recently doubled down on this, slashing the required payment period to 30 days.

Key Takeaways

Research shows that freelancers are often afraid to rock the boat in order to maintain a good relationship with their clients – but this shouldn’t be the case!

Of the 2 million freelancers working in the UK, 88% depend on freelancing as their main source of income. It therefore remains crucial for further changes to be made and for non-paying clients to be held accountable for unpaid invoices.

When a client doesn’t pay, it can often feel like there’s nowhere to turn. However, it’s important to remember that you do have options. Be sure to protect yourself and:

- Do your research before agreeing to work with a company, keeping the Prompt Payment Code signatories database in mind.

- Provide your client with a contract that sets out clear payment terms from the onset.

- Consider selling your invoices to a reputable third-party platform.

Be aware of your rights and take the appropriate legal action when necessary.